What Is The Property Tax Rate In Berkeley County Sc . · estimates based on values in classification only. Hard copies of the report will hit mailboxes soon. Based on the 2022/2023 millage rate and fees. Web property tax computation for 4% residential property in berkeley county. Web the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. Web berkeley county, south carolina. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. · do not use for agricultural or any other special. Web 2023 property tax rates by county is now available online. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,.

from www.chegg.com

Web berkeley county, south carolina. Hard copies of the report will hit mailboxes soon. Based on the 2022/2023 millage rate and fees. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web 2023 property tax rates by county is now available online. · do not use for agricultural or any other special. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. · estimates based on values in classification only. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web the amount of property tax due is based upon three elements:

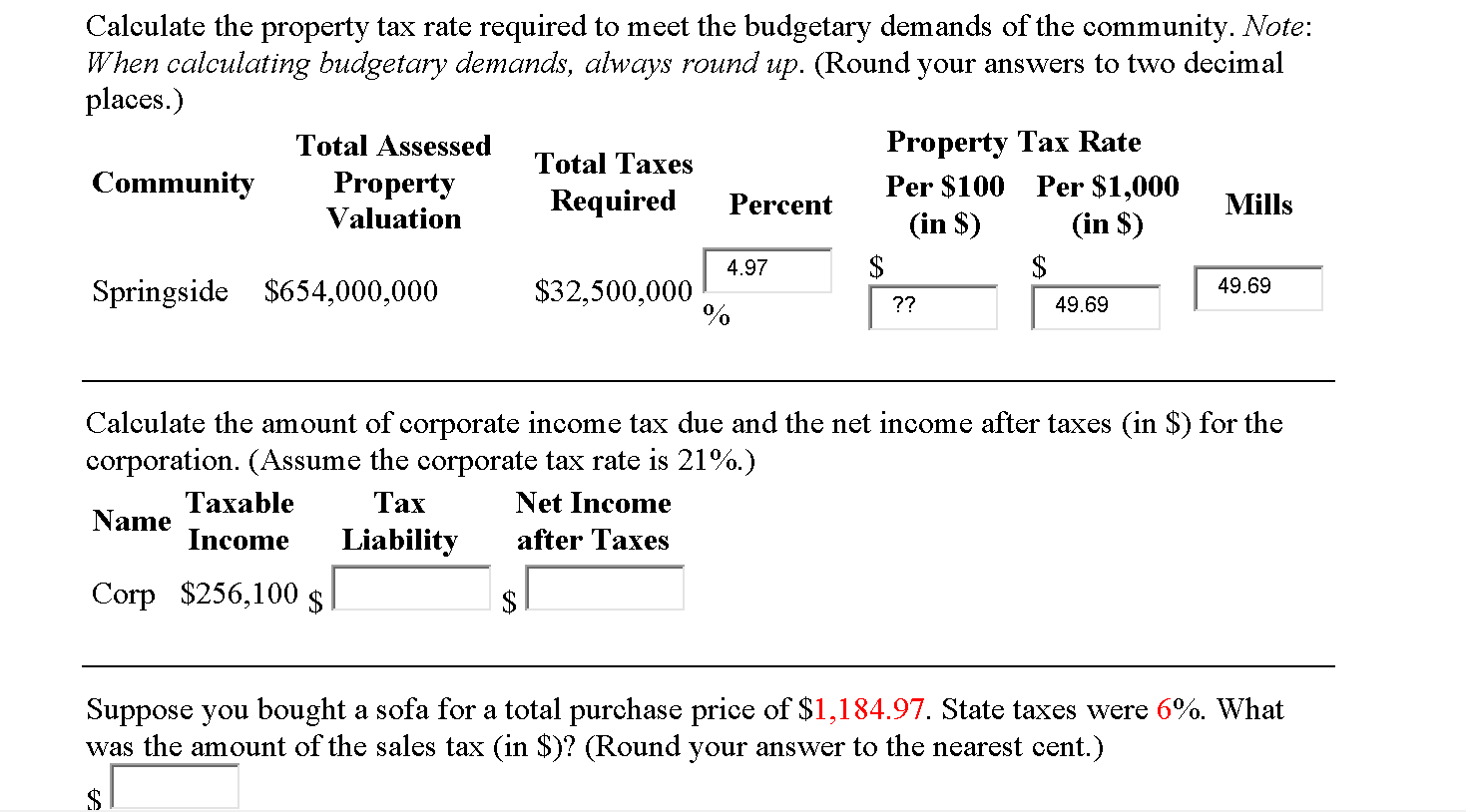

Calculate the property tax rate required to meet the

What Is The Property Tax Rate In Berkeley County Sc Web berkeley county, south carolina. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. · estimates based on values in classification only. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web 2023 property tax rates by county is now available online. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. (1) the property value, (2) the assessment ratio applicable to the. Hard copies of the report will hit mailboxes soon. Based on the 2022/2023 millage rate and fees. · do not use for agricultural or any other special. Web berkeley county, south carolina. Web the amount of property tax due is based upon three elements: Web property tax computation for 4% residential property in berkeley county.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation What Is The Property Tax Rate In Berkeley County Sc Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Based on the 2022/2023 millage rate and fees. Web the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. Hard copies of the report will hit mailboxes. What Is The Property Tax Rate In Berkeley County Sc.

From prorfety.blogspot.com

Property Tax Map Sc PRORFETY What Is The Property Tax Rate In Berkeley County Sc Web the amount of property tax due is based upon three elements: Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. · estimates based on values in classification only. Web 2023 property tax rates by county is now available online. Hard copies of the report will hit mailboxes. What Is The Property Tax Rate In Berkeley County Sc.

From dailysignal.com

How High Are Property Taxes in Your State? What Is The Property Tax Rate In Berkeley County Sc Hard copies of the report will hit mailboxes soon. Web property tax computation for 4% residential property in berkeley county. Web the amount of property tax due is based upon three elements: Web berkeley county, south carolina. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. · do. What Is The Property Tax Rate In Berkeley County Sc.

From www.mattoneillrealestate.com

South Carolina Real Property Tax Ultimate Guide for Charleston What Is The Property Tax Rate In Berkeley County Sc The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. (1) the property value, (2) the assessment ratio applicable to the. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. Web 2023 property tax rates by. What Is The Property Tax Rate In Berkeley County Sc.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation What Is The Property Tax Rate In Berkeley County Sc The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web property tax computation for 4% residential property in berkeley county. · estimates based on values in classification only. · do not. What Is The Property Tax Rate In Berkeley County Sc.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties What Is The Property Tax Rate In Berkeley County Sc · do not use for agricultural or any other special. Hard copies of the report will hit mailboxes soon. Web property tax computation for 4% residential property in berkeley county. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. (1) the property value, (2) the assessment ratio applicable to the. Web 2023. What Is The Property Tax Rate In Berkeley County Sc.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year What Is The Property Tax Rate In Berkeley County Sc Web the amount of property tax due is based upon three elements: Web 2023 property tax rates by county is now available online. Web berkeley county, south carolina. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. · do not use for agricultural or any other special. · estimates based on values. What Is The Property Tax Rate In Berkeley County Sc.

From www.klickitatcounty.org

Property Taxes Explained Klickitat County, WA What Is The Property Tax Rate In Berkeley County Sc Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web property tax computation for 4% residential property in berkeley county. Based on the 2022/2023 millage rate and fees. Web the amount. What Is The Property Tax Rate In Berkeley County Sc.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics What Is The Property Tax Rate In Berkeley County Sc Based on the 2022/2023 millage rate and fees. · do not use for agricultural or any other special. Web berkeley county, south carolina. Web property tax computation for 4% residential property in berkeley county. · estimates based on values in classification only. (1) the property value, (2) the assessment ratio applicable to the. Web the amount of property tax due. What Is The Property Tax Rate In Berkeley County Sc.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What Is The Property Tax Rate In Berkeley County Sc · do not use for agricultural or any other special. (1) the property value, (2) the assessment ratio applicable to the. Web the amount of property tax due is based upon three elements: Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web 2023 property tax rates by. What Is The Property Tax Rate In Berkeley County Sc.

From exooutykh.blob.core.windows.net

Property Tax Estimator Berkeley County Sc at Dennis Rumph blog What Is The Property Tax Rate In Berkeley County Sc Hard copies of the report will hit mailboxes soon. Based on the 2022/2023 millage rate and fees. · do not use for agricultural or any other special. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. The median property tax (also known as. What Is The Property Tax Rate In Berkeley County Sc.

From www.usnews.com

How Healthy Is Berkeley County, South Carolina? US News Healthiest What Is The Property Tax Rate In Berkeley County Sc Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web the amount of property tax due is based upon three elements: · estimates based on values in classification only. Based on the 2022/2023 millage rate and fees. The median property tax (also known as real estate tax) in. What Is The Property Tax Rate In Berkeley County Sc.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate What Is The Property Tax Rate In Berkeley County Sc Web the amount of property tax due is based upon three elements: Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half of the national. Web 2023 property tax rates by county is now available online. · do not use for agricultural or any other special. ·. What Is The Property Tax Rate In Berkeley County Sc.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow What Is The Property Tax Rate In Berkeley County Sc Web property tax computation for 4% residential property in berkeley county. Web the amount of property tax due is based upon three elements: Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. · estimates based on values in classification only. Based on the 2022/2023 millage rate and fees.. What Is The Property Tax Rate In Berkeley County Sc.

From exooutykh.blob.core.windows.net

Property Tax Estimator Berkeley County Sc at Dennis Rumph blog What Is The Property Tax Rate In Berkeley County Sc Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Based on the 2022/2023 millage rate and fees. · estimates based on values in classification only. Web the average effective property tax rate in berkeley county is 0.68%, which is slightly lower than the state average and about half. What Is The Property Tax Rate In Berkeley County Sc.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index What Is The Property Tax Rate In Berkeley County Sc Web 2023 property tax rates by county is now available online. Web property tax computation for 4% residential property in berkeley county. (1) the property value, (2) the assessment ratio applicable to the. · do not use for agricultural or any other special. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and. What Is The Property Tax Rate In Berkeley County Sc.

From www.uslandgrid.com

Berkeley County Tax Parcels / Ownership What Is The Property Tax Rate In Berkeley County Sc The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web 2023 property tax rates by county is now available online. · estimates based on values in classification only. (1) the property value, (2) the assessment ratio applicable to the. Web berkeley county, south carolina. Hard copies of the report will hit mailboxes. What Is The Property Tax Rate In Berkeley County Sc.

From www.sciway.net

Berkeley County, South Carolina Historical Maps What Is The Property Tax Rate In Berkeley County Sc (1) the property value, (2) the assessment ratio applicable to the. Web berkeley county, south carolina. Based on the 2022/2023 millage rate and fees. The median property tax (also known as real estate tax) in berkeley county is $761.00 per year,. Web our berkeley county property tax calculator can estimate your property taxes based on similar properties, and show you. What Is The Property Tax Rate In Berkeley County Sc.